The target audience for Financial Feminist is obviously women. But much of the financial advice Tori Dunlap dispenses is gender-neutral. Tori Dunlap grew up with money smarts. She saved pennies in a Altoids tin to buy theater tickets. She watched her parents balance their checkbook and budget their income. But, as Tori grew older, she noticed many of her female friends didn’t have a clue about how to handle money.

While the boys Tori knew were taught about investing and the dynamics of money, the girls were counseled to restrain their spending and save. Tori addresses this disparity by presenting practical plans to reduce debt and control spending while planning for a solid financial future.

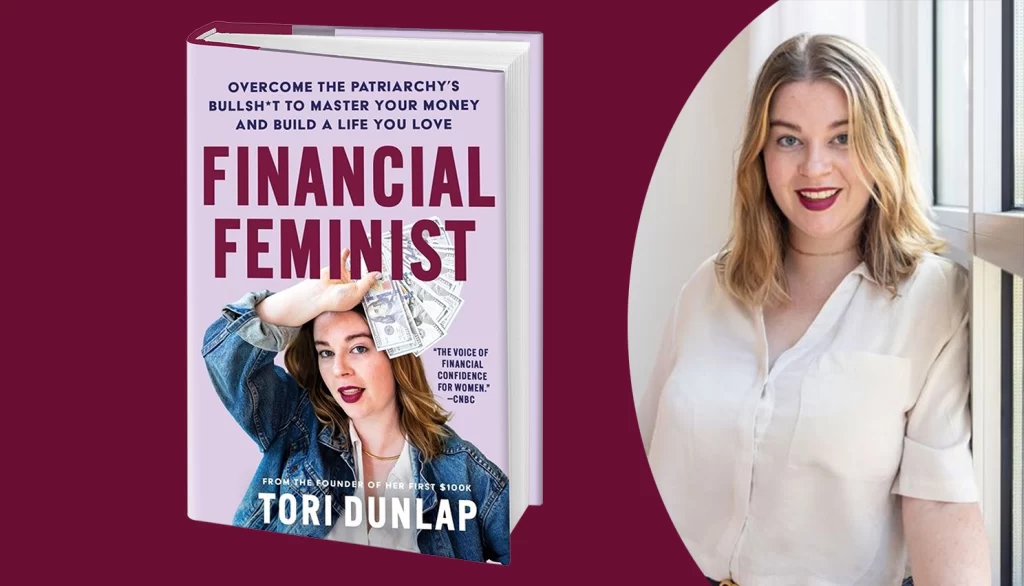

Sure, there are dozens of excellent financial advice books out there, but I found Tori Dunlap’s Financial Feminist feisty and forthright. If you want a breezy, provocative, and smart guide to how to handle your finances, here it is. How’s your financial situation? GRADE: A

TABLE OF CONTENTS:

Introduction ix

Chapter 1 The Emotions of Money 2

Chapter 2 Spending 42

Chapter 3 The Financial Game Plan 78

Chapter 4 Debt 116

Chapter 5 Investing 150

Chapter 6 Earning 192

Chapter 7 Living a Financial Feminist Lifestyle 242

Epilogue 281

Acknowledgments 283

Glossary 287

Notes 293

I’m rolling in dough and I’m not going to waste any of it on this book!

Bob, I borrowed FINANCIAL FEMINIST from my local Library.

Current status: still working, but preparing for retirement at some point in the not-too-distant future. I’ve always stressed to my three girls the importance of being financially secure and having marketable skills. Despite my parents’ very gender-traditional marriage (which worked perfectly for them, but would have never worked for me), I was not raised to think a man was going to take care of me financially, and I passed that idea down to my daughters: be responsible for yourself—you never know what the future holds. That being said, John and I have always had our money in joint accounts, have both our names on titles, mortgages, and other financial documents. But I’m the money manager—John refers to me as “the CFO of our marriage”, lol.

Deb, same here. Diane handles the checkbooks and I handle the investments. It helps that we have ZERO debt. Our house if paid for, the vehicles are bought with cash, and the credit cards get paid off completely each month. I’m not happy with the Inflated prices for just about everything. That’s just a tax on our lifestyle.

You and John showing your daughters how careful and responsible financial management looks like will improve their lives. And, I know you’re a great CFO! So is Diane!

I guess I’m just not much of a non-fiction reader, and most of the stuff you’ve been featuring lately would put me to sleep faster than an Ambien. The last non-fiction book I read was Tarantino’s CINEMA SPECULATION late last year and the only one on tap is the Collins biography of Mickey Spillane, if my library would quit dawdling around with processing it and get it to me.

Michael, you many not read much non-fiction, but your choices are solid! I enjoyed CINEMA SPECULATION and I’m looking forward to that Mikey Spillane biography.

Well, I went from zero debt to a huge rental payment every month so I know this woman would shake her finger at me. But I am only spending the money that I got for the house I sold. I figure it will take me ten years of rent to use that up. By then I will be in assisted living or dead I am sure.

Patti, housing can be a problem. Prices for houses, condos, and apartments are way up. We all have to explore the possibilities of assisted living as we age.

Jackie agrees but says “independent living ” rather than “assisted living ” like the place in Arizona we unsuccessfully tried to get my father to move to after my mother died. But he insisted that he was going to “die in my own home ” so there was nothing we could do.

Jeff, good point. My mother was in good physical shape when we moved her to the Northgate Memory Care unit. But her mental state–impaired short term memory issues–necessitated 24 hour care. Not a day goes by here were someone with Alzheimer’s or dementia is being searched for because they escaped their home or independent living facility.

My immediate comment to Jackie was, “Cap’n Bob is NOT going to read this one.”

Me either.

Our financial situation is much like the Kelleys’ but on a lower level, I’m sure. And I am the manager, because no matter how many times I show Jackie how to get into the accounts etc. her eyes glaze over. But everything is written down. No house so no mortgage, and we rent. Everything is paid off immediately, no debt, cars and everything else we want is bought for cash. We are in a position now where we don’t really have to consider whether we can afford something or not. If it is something we want enough, we get it. I mean, Jackie talks about a Bentley convertible, but she isn’t serious about it. We have no one we have to worry about leaving the money to, so we can rent in Florida for three months in the winter if we want to (we do).

Re Deb’s comment, we know people (my cousins, in particular) who have been together nearly as long as we have and married about 40 years, who still have separate bank accounts and have to determine who pays for what. I just can’t understand that. We’re not talking second marriage, different ages, previous children or anything else that would make that understandable. I just don’t get it.

Jeff, we know many couples who have separate accounts. Different strokes for different folks. We also know some friends who still have a mortgage on their house (because they moved 11 times!).

I’ve always had my own bank account. I’m not comfortable with a spouse spending my money. We divide the bills and I take care of my portion (more than half since I make more.)

Not for me. I manage my finances very well. Every year, I do a year end assessment of my assets, not counting property, just savings etc. It’s increased every year since I started. I have no debt and my house is paid for with low prop 13 taxes (Under $700 per year). This year I have a lot of expenses coming up, so may have a slight decline in assets, but the interest rates are coming back, so it may not be too bad.

I tried to paste a pix of my new “boyfriend”, Loki an 8 month old german shepard/lab mix. He won’t replace Roscoe in my heart, but he’s got his own place. Larry says he’s jealous

Maggie, I still own a bit of QUALCOMM although I sold the bulk of my shares a few years ago and bought oil and banking stocks. No pets here…I have too many allergies!

Loki belongs to my former next door neighbor. I had allergies, but thankfully no longer. I was able to pet sit for larry’s 2 female labs while he did softball tournaments and visited his daughter in MN. I now have blonde hair on most of my clothing from the girls

Maggie, clearly things worked out for you!