George Clooney plays a stock market guru TV guy (think Jim Cramer on CNBC) and Julia Roberts is his producer in the Control Room. During one of his shows, Clooney gets taken hostage by a disgruntled investor who followed Clooney’s advice on a stock that instead of going up went down down down. The investor, Kyle, lost his entire $60,000 investment and now he wants payback. Jodie Foster directed this movie, but the result is muddled. Is a a thriller? Not really, not enough action. Is it a psychological suspense movie? No, because we all pretty much know how this is going to end. Clooney and Roberts are polished and don’t break a sweat despite some of the antics of the police. I enjoyed this predictable movie, but I’m a fan of movies about the stock market. Your mileage (and interest) might differ. GRADE: B-

Author Archives: george

INCENTIVE TO RETIRE

My College is offering an Incentive to Retire to senior faculty (like me) in hopes of reducing the overhead of the organization. The College is struggling, as most colleges and universities are, with declining enrollments and steadily increasing costs. In December 2015, the College offered an incentive and 49 faculty members accepted it. The average Incentive was around $50,000. I considered the offer, but I wasn’t ready to put down my chalk and laser pointer yet. But this Incentive is rumored to be more money–and probably the last Incentive for a long long time since the College is running on fumes financially. Diane says she’ll go along with whatever decision I decide on, but I have a feeling she’d like me to be retired like she is. In fact, Diane will begin her 13th year of retirement in September. Astonishing! My original plan was to continue to teach until I turned 70, then retire and collect Social Security and my New York State Teacher’s pension. But now this Retirement Incentive and Social Security Spousal Benefits have changed the equation. As The Clash asks: “Should I Stay Or Should I Go?”

PLAYING WITH FIRE By Jennifer Nettles

I’ve been a big fan of Jennifer Nettles’s singing since her days in Sugarland. This solo CD features songs that display her versatility. There are traditional Country & Western songs, ballads, and pop songs on this CD. I liked “Unlove You” a lot. “Three Days in Bed” brought back some memories, some good some bad. If you’re in the mood for a special singer with talent to burn, I’d recommend a listen to Playing With Fire.. I included a sample below. GRADE: B+

TRACK LIST:

Playing with Fire

Unlove You

Hey Heartbreak

Drunk in Heels

Stupid Girl

Three Days in Bed

Sugar

Chaser

ing Over

Salvation Works

Way Back Home

My House [Feat Jennifer Lopez]

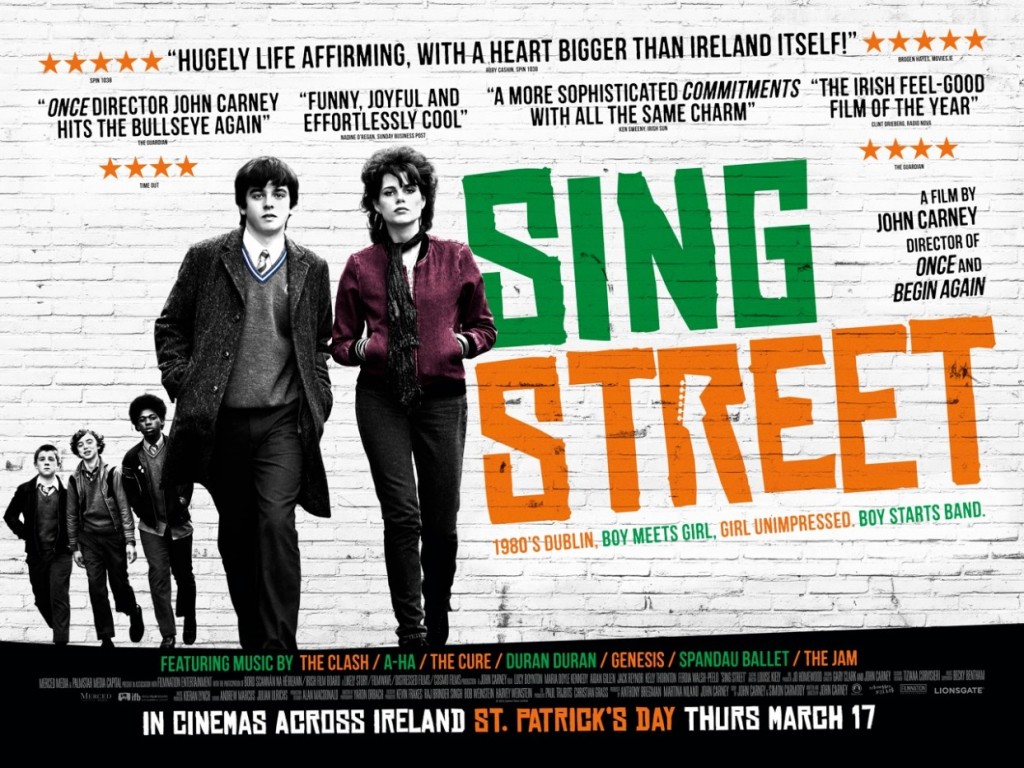

SING STREET

Sing Street will delight fans of The Commitments. The story is set in Ireland in the mid-1980s. John Carney, who wrote and directed Sing Street, gave this summery of his movie: “Boy meets girl. Girl Unimpressed. Boy starts band.” Connor (Ferdia Walson-Peelo) deals with a troubled family situation. Connor is sent to a crappy (but cheap) school where he gets beaten up and harassed by the priest running the cruel enterprise. But things change when Connor falls in love with Raphina (Lucy Boynton) who has aspirations to be a model. In a stunning maneuver, Connor invites Raphina to be part of his band’s music video. Amused, she agrees. The only problem is Connor doesn’t have a band. Life in Ireland in the Eighties isn’t much fun. Economic malaise stifles life. But Connor has a plan and you’re going to root for him to succeed. Carney also provides original music in the mode of Duran Duran, the Cure, and Joy Division. The soundtrack to Sing Street is worth a listen, too. GRADE: A-

TRACK LIST:

1. Rock N Roll Is A Risk (Dialogue) – Jack Reynor

2. Stay Clean – Motorhead

3. The Riddle of the Model – Sing Street

4. Rio – Duran Duran

5. Up – Sing Street

6. To Find you – Sing Street

7. Town Called Malice – The Jam

8. In Between Days – The Cure

9. A Beautiful Sea – Sing Street

10. Maneater – Daryl Hall & John Oates

11. Steppin’ Out – Joe Jackson

12. Drive It Like You Stole It – Sing Street

13. Up (Bedroom Mix) – Sing Street

14. Pop Muzik – M

15. Girls – Sing Street

16. Brown Shoes – Sing Street

17. Go Now – Adam Levine

18. Up – The Score

19. Drive It Like You Stole It – Hudson Thames

FORGOTTEN BOOKS #372: SCIENCE FICTION OF THE 50’s Edited By Martin H. Greenberg & Joseph Olander

Science Fiction of the 50s is part of a trilogy of anthologies; the other two volumes are Science Fiction of the 30s and Science Fiction of the 40s. You can read more about the AVON series here. Of the three volumes, I prefer Science Fiction of the 50s. Just glance at the stories in this volume. I started reading SF in the 1950s so many of these stories bring some fond memories with them. I recommend that you don’t read the informative introductions to the stories until you’ve finished reading the stories first. Sadly, those introductions contain spoilers but no warnings! If you’re as big a fan of 1950s Science Fiction as I am, you’ll really enjoy Science Fiction of the 50s.

TABLE OF CONTENTS:

Preface by Frederik Pohl

Spectator Sport by John D. MacDonald

Feedback by Katherine MacLean

DP by Jack Vance

The Liberation of Earth by William Tenn

A Work of Art by James Blish

The County of the Kind by Damon Knight

The Education of Tigress McCardle by C.M. Kornbluth

The Cage by A. Bertram Chandler

The Last of the Deliverers by Poul Anderson

A Bad Day for Sales by Fritz Leiber

Saucer of Loneliness by Theodore Sturgeon

Heirs Apparent by Robert Abernathy

Adrift on the Policy Level by Chan Davis

Short in the Chest by Margaret St Clair

5,271,009 by Alfred Bester

The Academy by Robert Sheckley

Nobody Bothers Gus by Algis Budrys

Happy Birthday Dear Jesus by Frederik Pohl

Bettyann by Kris Neville

Dark Interlude by Fredric Brown & Mack Reynolds

What Have I Done by Mark Clifton

Love O Careless Love by Barry N. Malzberg

THANK YOU By Meghan Trainor

I liked Meghan Trainor’s first CD, Title. My review of it is here. I liked Meghan Trainor’s doo-wop sound in songs like “My Selfish Heart.” This newly released CD, Thank You, is a hodgepodge of songs and styles. There’s some rap, some ballads, some pop songs. Diane listened to a few songs and remarked, “These songs all sound the same.” I did enjoy “NO,” “Kindly Calm Me Down,” “Friends,” and “Champagne Problems.” The best songs on this CD are the BONUS TRACKS: “Goosebumps” and “Throwback Love” which wouldn’t sound out of place on a transistor radio in the 1950s! But you can only get those tracks on the TARGET version of the CD. Let’s just says Meghan Trainor is having a slight “sophomore slump.” I’m sure her next CD will be much better. Check out Meghan singing “NO” in TARGET below. GRADE: B-

TRACK LIST:

1 Watch Me Do 2:50

2 Me Too 3:01

3 NO 3:34

4 Better (feat. Yo Gotti) 2:48

5 Hopeless Romantic 4:05

6 I Love Me 2:48

7 Kindly Calm Me Down 3:59

8 Woman Up 3:29

9 Just a Friend to You 2:45

10 I Won’t Let You Down 3:20

11 Dance Like Yo Daddy 3:03

12 Champagne Problems 3:42

13 Mom

14 Friends

15. Thank You

BONUS TRACKS:

16 Goosebumps

17 Throwback Love

MIDDLE CLASS WORKERS STRUGGLING IN “GIG” ECONOMY By George Kelley

The Buffalo News has published another one of my articles. You can read the original here. Some of you may have read this article thanks to Bill Crider’s blog. Bill provided the link and some of you commented insightfully here.

Or you can read the text below:

“I’ve worked for General Motors for over 20 years. I’ve earned over $2 million … and I’m broke.”

I was hired by General Motors to teach “It’s Your Money,” a financial literacy course. About a dozen GM workers signed up for the course. I opened the first class by going around the table asking each worker why he decided to take the course. That’s when one of the participants admitted he had no savings despite earning millions of dollars.

The other workers jumped in with similar stories. These were hardworking assembly line employees. Frequently, they worked 10 hours a day, six days a week. Some admitted they had six-digit incomes. Yet almost every worker in my class said that he had zero savings.

In the latest issue of the Atlantic, writer and critic Neal Gabler appears with a paper bag over his head. Gabler confesses he could not come up with $400 cash if an emergency struck. And Gabler says 47 percent of working Americans couldn’t come up with the money, either.

How did we get to this point in America where people who work hard, have graduate degrees and own homes find themselves so cash poor?

I found most of my GM workers, despite making a lot of money, spent a lot of money. The worker who uttered that statement about making $2 million working for General Motors over the years admitted that he had an all-terrain vehicle, Jet Skis and a boat. One of my suggestions was that he divest himself of some of these “toys” and bank the savings.

Few schools offer courses in money management. Gabler confesses he knows very little about money matters, which explains a lot about his current insolvent monetary position. But if Gabler had a course in handling money back in high school or college, he probably wouldn’t be in the cash-strapped position that he and millions of Americans find themselves in today.

In America, the middle class is being squeezed. Technology transforms jobs. The old Little Rock needed 300 sailors to man the ship. The new Little Rock needs only 64 sailors to do the work because of all the new technology. You can see this same scenario being played out in industry, health care and agriculture.

At the same time technology changes the workplace, students discover they need more and more education to make themselves employable. A generation ago, a high school diploma could get you a pretty good job. Now, many jobs require a college degree. And in order to acquire that college degree, many students plunge into massive student loan debt.

The total of student loan debts exceeds credit card debt in America. But the two debts go hand in hand. The same people working two jobs to pay off their student loan debts frequently resort to using their credit cards to pay for necessities when they come up short.

Young Americans also find themselves stuck in a “gig economy.” Gone are the days where you would work for a company for 30 years and get a pension. Now, many jobs are short term “gigs” where the worker is hired as a private contractor with little or no benefits. Once the project is concluded, the job goes away. And the stressful job hunt begins again.

How can stressed-out members of the middle class survive in this new, transitory economy? I have three suggestions:

1.) Lower your expenses. Do you need a 2,500-square-foot house? Downsizing to a 1,500-square-foot home would save a lot of money in heating, cooling and taxes. Do you need two cars? Do you need 500 channels? Reduce your expenses and the result will be money you can save or invest.

2.) Have multiple revenue streams. Your job may pay for your day-to-day expenses, but you might need a second job to keep yourself financially secure. Investing in high-dividend stocks can also provide needed cash flow.

3.) Take a money management course.

These steps should ensure that you’ll have at least $400 if an emergency strikes.

George Kelley, of North Tonawanda, is a professor at Erie Community College City Campus.

SPLASH [Blu-ray]

Splash just appeared in Blu-ray format so of course I had to buy a copy. I really like this silly movie about Ton Hanks falling in love with a mermaid. Daryl Hannah, Eugene Levy, and John Candy fill out the talented cast. This was an early film (1984) in Ron Howard’s directing career so it bursts with energy and fun. Special features include an audio commentary and Making A Splash, a 24 minute interview that includes Ron Howard, Brian Grazer, Daryl Hannah, Eugene Levy, Babaloo Mandel, Lowell Ganz, and Tom Hanks as they talk about the making of Splash. I really enjoyed the Audition Tapes with both Tom Hanks’s and Daryl Hannah’s original auditions for Ron Howard. Nice package!

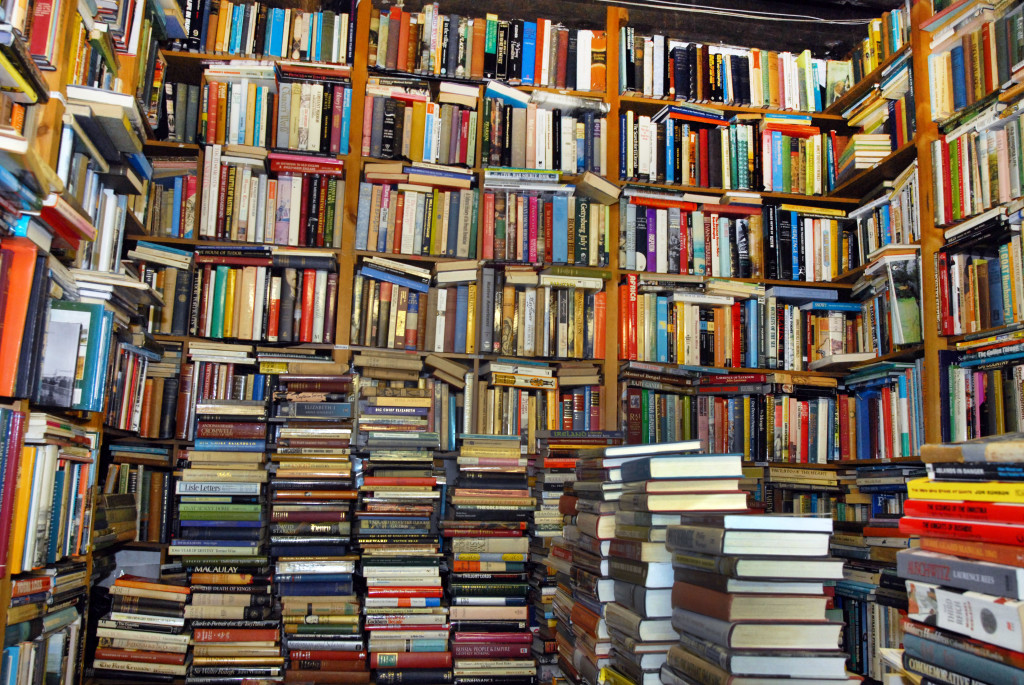

THE BOOK OUTLET R.I.P.

After 15 wonderful years, our local remainder bookstore, The Book Outlet, is closing its doors. You won’t be surprised to learn I bought over 1000 books from The Book Outlet over those years. The books were organized by sections–Science Fiction, Mysteries, Large Print, Biographies, etc–so it was easy to find what you were looking for. New stock arrived weekly. The BARGAIN section (aka, Books for a Buck) was a favorite of mine. Over the years, the stock morphed several times. The owner tried to attract a younger audience by stocking comic books and graphic novels. Then there was the great doll experiment when dolls competed with books for shelf space. But in the end, The Book Outlet succumbed to changing times and the ever-increasing costs of its lease. Today is the last day The Book Outlet will be open. I intend to drive over and buy one last book. Western New York is down to just a handful of used bookstores now. It’s a sad day.

NEW KITCHEN TABLE & CHAIRS

Our new Bassett kitchen table and chairs arrived last week. After living with the new furniture for a while, Diane pronounced the new set acceptable. The tulips are the arrangement Patrick and Katie sent Diane for Mother’s Day. Diane took this photo with her iPhone. The next planned acquisition: a new refrigerator for the kitchen. But that’s a month away at least.