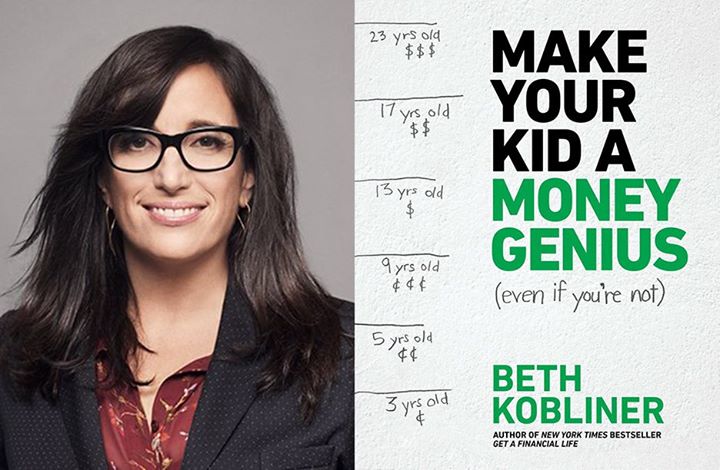

Beth Kobliner’s informative and useful book’s full title is: Make Your Kid a Money Genius (even if you’re not): A Parent’s Guide for Kids 3 to 23. Kobliner’s topics highlight the imporance of talking to your kids (or grandkids) about money at an early age. She uses plenty of practical examples to illustrate her points. Here is one of my favorite examples:

“THE LESS MONEY YOU SPEND ON THE WEDDING, THE LONGER YOUR MARRIAGE IS LIKELY TO LAST: Contrary to what marketing by the wedding industry suggests, couples across all income levels who spend big on their weddings are likelier to split than frugal couples are…. According to the Emory University study, couples who spent more than $20,000 on their nuputials were 3.5 times more prone to break up than ones who budgeted modestly ($5,000-10,000) The researchers speculated that, like an expensive engagement ring, a big wedding can result in debt that strains a new marriage.” (p. 119-120)

I recommend Make Your Kid a Money Genius because it is well-written and practical. Many financial advice books are not. GRADE: A

TABLE OF CONTENTS:

Introduction 1

1. 14 Rules for Talking to Your Kids About Money 5

2. Save More 17

3. Hard Work Pays 41

4. Drop Debt 67

5. Better, Smarter Spending 97

6. Get Insured 121

7. The Plain Truth About Investing 137

8. Give Back

9. Your Kid’s Most Important Financial Decision: College 179

10 Financial Advice for You, the Parent 206

Special Acknowledgements 217

Acknowledgements 219

Books for Further Reading 223

Notes 227

Index 243

YAWN!!!

Bob, you have grandkids who you could help with money management.

Kids today don’t know how to cross a street, go to the grocery story or handle money. But give them a ipad or computer and they are whizz kids.

Patti, you’re right. But not knowing how to handle money and make financial decisions can’t undone with an iPad.

I fear for the future!

Deb, the future is a scary place, but money helps with the defenses! You and your daughters would read the chapter on Student Loans. Very informative!

I’m more of a “money ostrich.” I fear for my own future. I didn’t used to be that way, but I’ve turned. I realize smart people turn it the other way around, but you’ll never catch me claiming to be intelligent. I prefer “love sponge,” after the reggae song. I have no idea what that means but the melody is catchy. That pretty much sums up my financial acumen. I just bought an autographed paperback by Bruno Fischer. Why? Because I’ve never even heard of one before. I may not be a genius, just a love sponge. With a signed Bruno Fischer Gold Medal original. I suppose they can bury me with it.

Rick, I think having an autographed copy of a Bruno Fischer Gold Medal is very cool. And, as time goes on, it may be worth more money than you paid for it. I’d say it’s a good investment!

The wedding thing certainly makes sense to me. Jackie’s sister had the fancy engagement ring, the big wedding a month after ours, etc. yet it seemed doomed from the start and only their kids kept them together 19 years. We canceled our planned big wedding, got married in the rabbi’s study and had a small reception (about 35 people) in a restaurant, with a delayed honeymoon in London six months later. 46 years later… .

We are definitely smarter about money now than we used to be, but a lot of it was luck and timing. I see how my nieces and nephews seem totally clueless (and uncaring) for the most part, and hope they inherit enough to make up for their lack of planning.

Jeff, those wedding statistics really struck home. I’ve seen some young people spend lavishly on their weddings only to get divorced just a year later! Tragic!

My grandparents and parents lived through the Depression, and I grew up hearing about saving, frugality, worth of money, earning and keeping, planning instead of spending. Sure, I blew money on stuff as a teen, such as records, books and milkshakes, but I was also working at a burger joint and saved half of my after-tax earnings. I continued as a saver all through my work career, and while others were going on fancy trips and buying cool toys like Jetskis, I saved and worked in the garden. (I do wish I’d learned to ski, though). If I hadn’t saved and put money into 401K and retirement accounts, I wouldn’t have the comfortable retirement I do.

So, yes, this sounds like one today’s parents and teens should pay attention to.

Oh, the wedding thing? Justice of the Peace at the Courthouse: $50. Late wedding lunch with friends: $0, they picked up the check. Bottle of champagne: $0 a gift. I guess we’ll stay married a long time.

Rick, you did it the Smart Way. We had 86 people at our wedding (mostly Diane’s friends and colleagues from school and family members). We held the reception at our favorite restaurant and skipped the music and dancing. Most people ordered steak and loved the Cinzano Asti Spumante.

I agree about the big wedding costs. Why pay all that money for a memory that really is about people rather than bling? The money not spent could be used as a down payment on a house. A costly ring can wait till a significant anniversary.

My parents instilled saving money in me at an early age. I only had one car loan (first new car, 3rd car) and after that paid cash. When I paid off my house, I saved the house payment in an IRA. I only had credit card debt for about 3 months (when my books I was selling in toronto didn’t get there, and when I called all over the country buying up copies of Booked to Die by Dunning). I pay my credit card bill in full every month. I prepay many utilities by rounding up (I make less subtraction errors by writing checks for an even dollar amount.) My accountant (who has very wealthy clients, many qualcomm and costco millionaires) says he doesn’t worry about me. I am sure I’m his least wealthy client. He says I always find a way to get by (said this after I claimed a nearly $700 refund check for at&t overcharging.)

Maggie, the Wedding Industry is relentless in marketing the concept of big, elaborate (and expensive!) weddings. My niece is getting married in October on a beach in Florida. Pricey.

I remember we went to Jackie’s friend’s wedding shortly after we got married. They had been living together for years and her mother was so desperate for a wedding that she was willing to do anything to get them hitched. She had $10,000 worth of flowers flown in from Hawaii (this was 1971-72)! It was the only wedding I can remember where the bride’s sister openly passed a hash pipe around during the reception!

Yes, they are still married.

Jeff, that 10K would have got them a nice car, instead of flowers that were dead in a few days or less. What a waste.

That was our thought even at the time. What a waste. I paid $2,300 for a new VW Beetle then.

my friend nancy went to a wedding last year that had to have cost $200k minimum. Held at a pricey venue in Brooklyn, and pricey dinner. There was a private dinner that was also beyond belief prior to the wedding that she said was really posh. Her friends are brides parents and are very very wealthy. She treated herself and flew first class to NYC.

Maggie, some people are all about the wedding. But then it can be downhill from there.