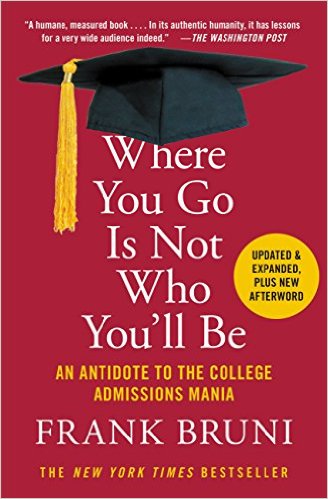

“It’s not where you go to school, it’s what you DO when you get there.” That’s the message I give my students who are concerned about getting accepted by the four-year College or University they dream about. Of course, a lot of those dreams are created by the marketing departments of those Colleges and Universities. Higher Education is a business. Today, students are lured to expensive colleges where they end up taking out student loans and end up heavily in debt. Frank Bruni identifies rational search methods to match students with schools that provide good educations and that are affordable. Yes, attending an Ivy League school offers a different experience than attending the local community college. Your roommate is likely to have a multi-millionaire parent. But, beyond the networking aspects, the actual education might be roughly equivalent.

Class sizes at my College are capped at 32 students. At SUNY at Buffalo, the “elite” school in our area, many courses have 300 students in them. Vastly different learning experience! I learn all of my students’s names within a week or two. If you’re in an auditorium with 300 students, the professor will not be trying to learn anybody’s name. I urge all of my students who plan to attend a four-year College after getting their Associate’s Degree, to visit the College they’re interested in attending. Actually sit in on a class. Talk to other students and ask them what they think of that College. Students sometimes supply surprising answers. But the obsession for some students and their parents to be accepted by a “name” school is fueled by the emails, videos, and Internet marketing that seems to have run amok. No wonder most college graduates find themselves drowning in debt. Where You Go is Not Who You’ll Be is a good antidote to this Admissions mania. GRADE: A

TABLE OF CONTENTS:

INTRODUCTION

1. The Unsung Alma Maters

2. Throwing Darts

3. Obsessives at the Gate

4. Rankings and Wrongs

5. Beyond the Comfort Zone

6. From Tempe to Waterloo

7. An Elite Edge?

8. Strangled with Ivy

9. Humbled, Hungry, and Flourishing

10. Fire Over Formula

11. Beyond the B-Plus

AFTERWARD

Suggested Readings and Resources

Acknowledgements

About the Author

INDEX

That is one of the things I never understood about the British and US university system …

In Germany you might say “all universities are created equal” and funnily enough the few private universities don’t have a really good image:

They are usually considered as the last resort for children of rich parents who want/”need” a degree but won’t make it in a state university.

Any way most students (at least in my times, 50 years ago, and today too) go to the next available university.

I travelled by train for the first semesters, living at home until I could afford a room – dormitories were and still are almost unknown n Germany and many other European countries ..

Re the size of classes:

I remember very well that there wee about 200 people sitting in the first math class but after a week that had dwindled to maybe 50 …

Obviously many students had completely different ideas what Higher math was about – so they abandoned it quickly.

Wolf, in the U.S. colleges and universities compete for students. They spend plenty on advertising and marketing. And much of the education budget goes to “administration” which is a Black Hole. Some Colleges, like mine, are “open admissions” colleges which means we have to accept anyone who applies for admission. Like your math course that went from 200 to 50, we have a “weeding out” process.

I did a two-year degree then stayed out for a year waitressing to save enough money to go to a four- year school and complete my degree. Yes, it was a different era then (late seventies), but the day I graduated I had $700 in my savings and no debt!

We’re in the final phase for our twins (high school seniors) right now. They have great ACT scores and GPAs, but we’ve been very focused on getting them the best financial offers possible as opposed to getting into the most prestigious school (much to their chagrin). We think (hope) that between scholarships and working, the girls can make it through college without incurring massive debt. Our oldest did three years at a small state school and still ended up owing over $20,000. How does this happen?

Deb, the game is rigged to extract money from College students. It’s not just the tuition costs. “Room & Board” and “lab fees” and the cost of textbooks keep going up. Your daughters will thank yo years from now when they graduate relatively debt-free while their friends are drowning in student loan debt.

I’ve read Bruni’s columns on education for as long as he’s been writing them in the NY Times and they are always sensible. This should probably be a must-read for every family with kids getting ready to go to college.

We were lucky when we were young, as we were able to get an excellent education at the City University of NY (which includes Brooklyn, City, Hunter, Queens, and Lehman Colleges, among others, including community colleges), for virtually nothing. We paid $54, not a credit but a TERM! And Jackie’s mother was a teacher, so at the time her union reimbursed her for the cost of her textbooks! We had excellent teachers too. Jackie may have hated him, but she was taught by (slumming) visiting Yale Professor and Joyce biographer Richard Ellmann.

Things are out of hand now. You see schools spending literally millions on a football stadium and the like, and the money has to come from somewhere, I guess.

I was amused watching MADAM SECRETARY when she took her daughter to look at a college, and someone told the daughter for a guaranteed scholarship she should play the French horn.

Good luck, Deb. I do not envy parents and students these days.

Yes, I was in school when Hunter College started their “open enrollment” program and, frankly, it is a disaster. NOT EVERYONE IS COLLEGE MATERIAL and we should not be pressuring kids to go to school and get into horrendous debt just because they feel they have to go.

Jeff, too many colleges and universities accept students who aren’t ready to do college work simply to make money. It’s a shame.

We were able to put my kids through U of Michigan with no loans. They both worked during the school year and in the summer. A lot of their peers could afford to do internships but not us.

It was more affordable 20 years ago. Law school put my son and his wife into debt. Luckily Megan was on money in grad school. The problem is that there are no four year colleges that aren’t pretty $$$ now. Even mediocre ones. Until people value educated citizens in this country they will not be willing to pay enough taxes to achieve this.

Patti, the states and local governments have reduced their financial support for colleges and universities. So tuition goes up and students are forced to take out massive loans. It’s a brutal cycle.

We worked in the summers too. I worked one year on the 55th floor of the Empire State Building. The elevator I had to take went straight from 1 to 55! Your stomach took a while to catch up.

What happened to me was, partly due to pressure from my father, I went to the wrong school at first. I knew it was wrong almost immediately but it took months to deal with it and withdraw. I then gained some of the best experience of my life by going to work in the city for two years before returning to college.

Jeff, I worked summers at a Goodyear plant in Niagara Falls. The money I made in three months covered most of my college expenses. When I went to the University of Wisconsin-Madison for my PhD. I worked in their Children’s Literature Collection as a librarian which paid for my expenses. No debt.

Early seventies, California, community college! Tuition per quarter was $3.50!

I did that too, though it was the late Sixties,. It was per unit, Bob, not per quarter or semester. Still dirt cheap. Even when I went on to the four-year college, University of Arizona, it wasn’t that much except for the out-of-state fee of $250 per semester. So $500 per year plus $200 books/tuition/ not bad. I worked every summer to help pay for it.

Bob, that’s when college was affordable. Now, it isn’t.

I don’t remember paying for classes, only books and lab fees! I also collected from the VA!

Bob, I have some students who are veterans and they get tuition assistance but they have to do a lot of paperwork to get it.