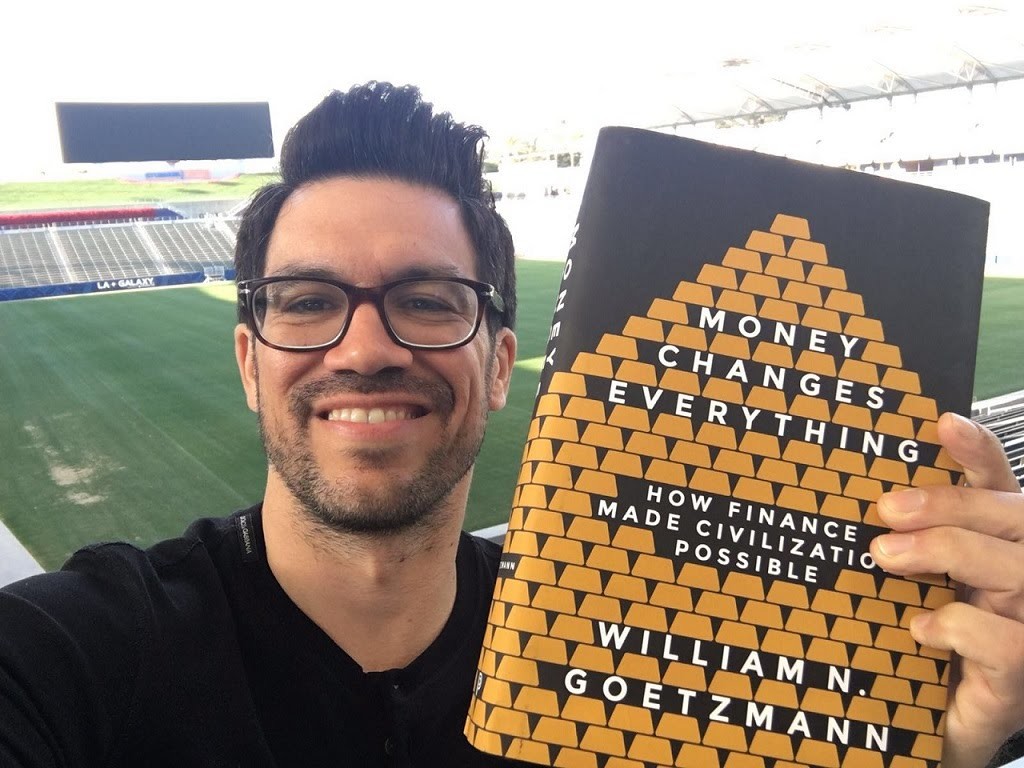

Yesterday I reviewed Charles Stross’s space operas that explored the nature of money in the Future. Today, I’m celebrating a wonderful history of money by William N. Goetzmann. Financial history can be dry and dull, but Goetzmann’s writing is lively and insighful. And Goetzmann shows how money developed in China (usually ignored). I completely agree with Goetzmann’s assertions that money and cities are essential to developing a civilized society. Most readers will find Goetzmann’s chapters on the emergence of global markets most relevant to their financial decision making. If you’re interested in money (and who isn’t?), Money Changes Everything provides a clear, detailed history. Highly recommended! GRADE: A

TABLE OF CONTENTS:

Introduction

PART I FROM CUNEIFORM TO CLASSICAL CIVILIZATION 15

PART II THE FINANCIAL LEGACY OF CHINA 137

PART III THE EUROPEAN CRUCIBLE 203

PART IV THE EMERGENCE OF GLOBAL MARKETS 401

Conclusion 519

Notes 523

Bibliography 541

Illustration Credits 555

Index

another book I want to read, but not time due to review obligations. Maybe the library will get an audio of it.

Right now, while I still have vehicles with cassette players I’m listening to books on cassette that I have, mostly books I’ve already read.. So far, a mary higgins clark novella, the eagle has flown by jack higgins, strip tease by carl hiaasen, jolie blon’s bounce by james lee burke, and a john lescroat dismas hardy book.

Maggie, our last car with a cassette player in it got turned in about three years ago. Now, the new cars don’t come with CD players!

Speaking from personal experience, I can 100% agree that money changes everything! We spent years trying to get ahead, but once we did it was a totally different world for us. We may not be in the Kelley category, but we can pretty much do or buy whatever we want. (Granted, we don’t “want” to buy a million dollar home or a Maserati.)

Jeff, Charles Dickens once wrote: “Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.” Diane and I love to spend money, but we hate to waste money.

Another 500 pages to read???

OK, it’s a long and complicated story – just don’t have the time for it …

Even as a pensioner – there are so many things to do!

Wolf, some of the contents of MONEY CHANGES EVERYTHING will find its way into my lectures this Fall Semester. You might be interested in the chapters of the mathematics of finance in MONEY CHANGES EVERYTHING.

and the author just had to take a “selfie” with his book. Sigh. What a world it is, and I’m thinking an awful lot of it is ridiculous. As for the book, at this stage, I’m as set as I’ll ever be, it’s a mater of burn-through now, and our financial advisor says we’re doing fine on that. We don’t spend much on non-necessities, I buy few books or CDs (or music downloads) these days, Barbara buys few extras and our only ongoing expense not basics related is things related to the garden, which is important to us, and therapeutic. So, yes, without any money we personally would be in grave circumstances, but as a society, without the money-type exchange tool, it would have been difficult. I can’t see carrying a chicken into Starbucks to trade it for coffee beans.

Maybe not, but I’d love to see you try!

Between two Social Security payments, Jackie’s pension, the money we invested over the years from her salary, and inheritances from both sets of parents, not to mention no children to support and no house payments, we are more than OK.

But we know a lot of people who aren’t.

Jeff, we know a lot of people who retired at 55 and are now starting to struggle. Being on the fixed income is a balancing act. Expenses continue to increase. Health costs rise. Without careful planning, disaster lurks.

Rick, I’m focused on the development of money and the financial system. And what comes next. That’s why Stross’s NEPTUNE’S BROOD appealed to me despite the pedantic aspects.

I retired at 50, something I couldn’t have done without paying off my house and having a pension. I also had a $400/mo health insurance allowance, which at the beginning covered kaiser, dental and some left over. By the time I got medicare, I was paying another $389/mo for kaiser so my pension was reduced to well under $600/mo. I made do, doing a lot of shopping at the 99c store and the bargain bins at grocery stores. I also had few grocery expenses while I was helping the 2 old ladies. They bought tons of food and often gave me perfectly good things they wouldn’t eat (leftovers, etc) Once I went 2 weeks without spending a cent on food.

I’m going to delay getting soc sec til 68 years old, or at least that’s the plan now.

Maggie, Diane started collecting Social Security last year when she turned 66. I’m collecting Spousal Benefits now and will collect my Social Security benefits when I turn 70 in 2019. And my New York State Teacher’s Retirement pension will start sending me monthly checks in January 2017.

YAWN!

Bob, money always wakes me up!