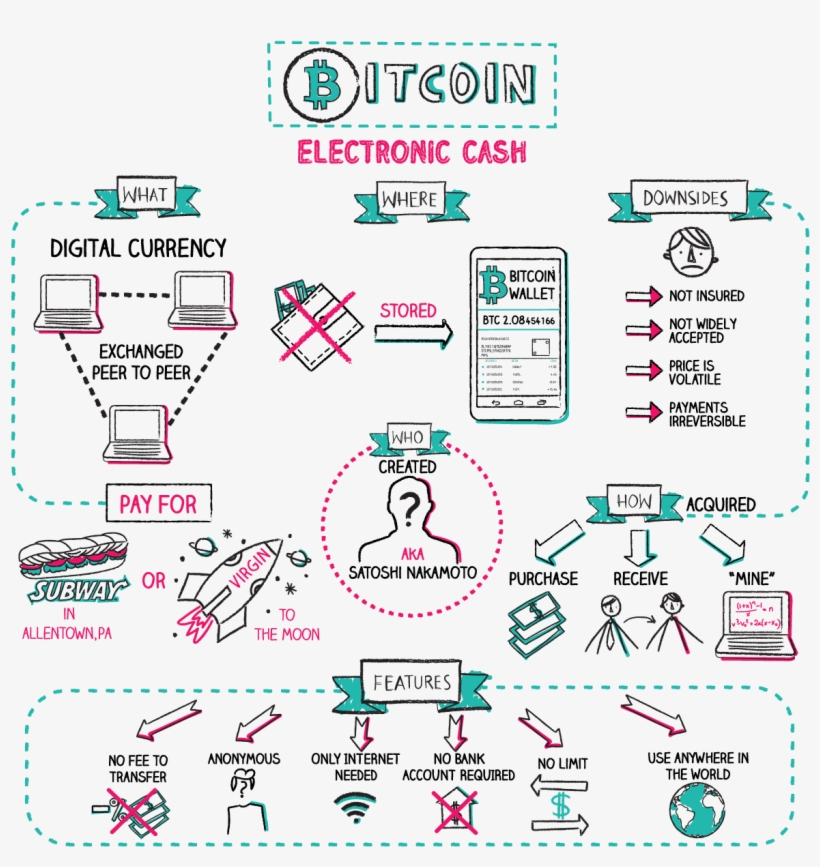

Tina Hay has an MBA from Havard and a knack of making complex and complicated financial concepts easily understood. Tina Hay uses doodles on napkins to illustrate financial topics like compound interest and how credit cards work. The doodles look like flow charts (check out the one on Bitcoin below). Napkin Finance covers all the basic financial topics and offers plenty of examples how you can improve your monetary position with a little tweaking. I especially enjoyed the “Chapter Quizzes” that help to make sure readers understand what they’ve been reading.

Most of the commentators on this blog would find much to ponder in Chapter 5: INTO THE SUNSET. Paying for retirement, dealing with Social Security, and the fundamentals of estate planning are all topics that concern us. Tina Hay lays it all out in an understandable fashion. And, for those of you who are about to do your taxes, Chapter 7: EZ Does It, provides some insights that might put more money in your pocket. Napkin Finance is one of the best personal finance books I’ve encountered. Highly recommended! GRADE: A

TABLE OF CONTENTS:

1. Money 101 — 1

Compound interest 2

Savings 4

Budget 7

Debt 10

Interest 14

Banks 17

Emergency Fund 20

Insurance 23

Chapter Quiz 26

2. Credit where it’s due — 30

Credit 31

Credit Cards 34

Improving Credit 37

FICO Credit Score 41

Chapter Quiz 44

3. Buy low, sell high — 48

Investing 49

Asset Classes 53

Diversification 56

Risk vs. Reward 59

Asset Allocation 63

Robo-Advisor 67

Chapter Quiz 70

4. Paying your dues — 74

Paying for College 75

Student Loans 78

FAFSA 82

529 Plan 85

Paying Off Student Loans 88

Chapter Quiz 92

5. Into the sunset — 96

Paying for Retirement 97

IRA vs. 401(k) 101

Social Security 104

Estate Planning 107

Chapter Quiz 110

6. A wild ride — 114

Stocks 115

Stock Market 118

Bull or Bear Market 122

Mutual Funds 126

ETFs 130

Bonds 134

What is an IPO? 137

Chapter Quiz 140

7. EZ does it — 144

Taxes 145

Tax Returns 148

1099 vs. W-2 Employee 152

Tax Deductions 156

Chapter Quiz 160

8. Go big — 164

Entrepreneurship 165

How to Start a Start-Up 168

Business Plan 172

Financing a Start-Up 175

Chapter Quiz 179

9. Voodoo economics — 182

GDP 183

Inflation 186

Recession 190

The Fed 193

Chapter Quiz 197

10. The bottom line — 200

Financial Statements 201

Profit & Loss 204

Balance Sheet 207

Liability 210

Chapter Quiz 213

11. The future of money — 216

Cryptocurrency 217

Bitcoin 221

Initial Coin Offering 224

Blockchain 227

Chapter Quiz 231

12. Wow your friends — 234

Rule of 72 235

Crowdfunding 238

Philanthropy 242

Hedge Funds 246

Invisible Hand 250

Game Theory 254

Chapter Quiz 257

Conclusion — 261

Acknowledgements — 263

Bibliography — 265

It does sound useful, though to be honest, that chart did not explain bitcoin at all to me. Does the “Voodoo economics” chapter talk about Reaganomics and the ongoing Republican “tax cuts for the wealthy” scam?

Jeff, yes. The Voodoo Economics chapter deals with all the disinformation about the Economy. Bitcoin is confusing under all conditions. This is about the best description of the cryptocurrency that I’ve encountered. Obvious, I don’t own any bitcoin.

A few years ago I became aware of bitcoin and 3-D printers around the same time. I still don’t understand either of them and have decided I don’t care.

Michael, I think 3-D printers have a big potential to impact the Economy. Bitcoin…not so much.

Three-D printers could be the future of model kit manufacturing since molds are so expensive! But this book holds no interest for me! The best financial advise I can give is don’t buy books about financial advise, or finance in general!

Bob, learning more about money always pays off!

This is an interesting book. I’ll see if my library has it.

I do manage my money very well, and am sorry to see interest rates going down. The smartest thing I did was buy my house in 1975 (the dumbest thing was not to have spent $40K (versus $25K) and get a house at the beach – inland not right on the boardwalk)

I’m not a whiz like you are at the stock market, though. My first purchase was either Pixar (my friend scott recommended it as he is an animation fan. I bought it at 19.63. It’s now Disney.) or Qualcomm – our paper’s former financial guy recommended it. I bought it right before it quadruple split (6.15) I sold enough of it that I have none of my own money in the stock market, it’s all profit.

I hope the chapter on seniors had the caution against reverse mortgages. I know 2 elderly ladies that got taken in my that (IMHO) scam. One was in a skilled nursing facility and died about a month and a half before she would have lost her house. She had no chlldren, so the only loss would have been to her creditors. I can’t believe people fall for that.

Maggie, I shudder when I see those Reverse Mortgages advertised on TV. The gullible will fall for the scheme and end up losing their home for a pittance and find themselves stuck with the taxes and expenses. Pixar (aka, DISNEY) and Qualcomm (QCOM) made you a lot of money. But the coronavirus will hurt those two stocks in the short-run.