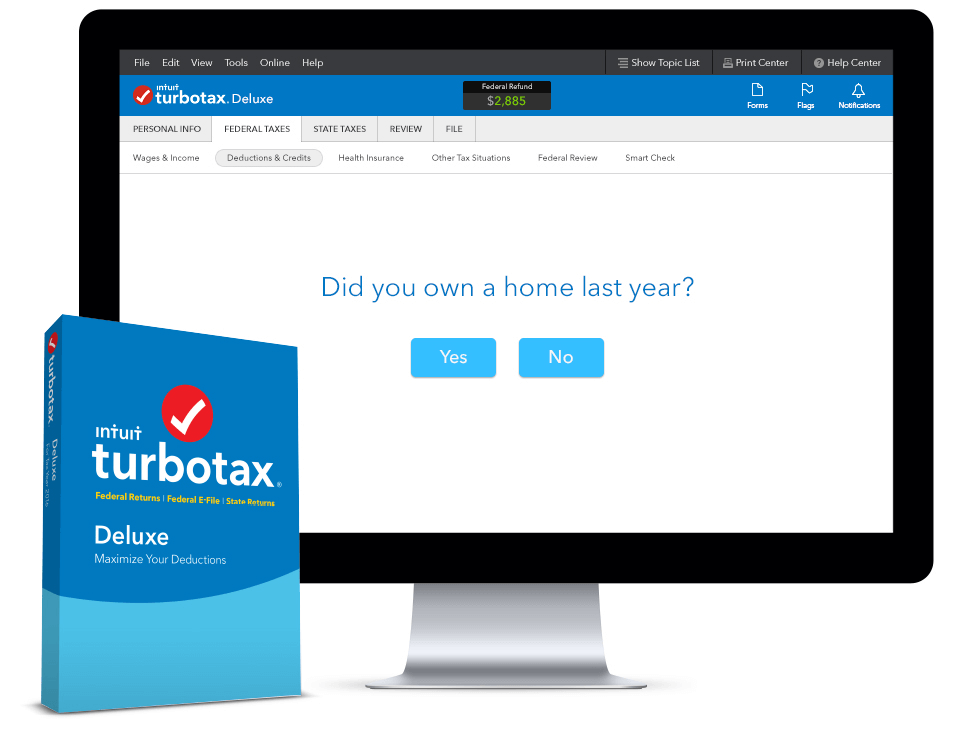

For the past 20 years or so, I’ve used TURBOTAX to prepare my Federal and State taxes. The early versions were sometimes overly complicated and frustrating to use. But, as time went on, Intuit (the company that makes TURBOTAX) improved the product so today’s version is simple and easy to use. I was worried that because I prepared my taxes on my DELL (Windows) computer last year, the TURBOTAX file wouldn’t be read by my new Apple iMac computer. But, no problems. I just inserted my USB drive with my tax files and TURBOTAX transferred all the information. Easy peasy!

Sadly, we have pay the Feds about $500 and New York State about $1,500. I’ll have to adjust our Withholdings for next year. Of course, next year we’ll take the new higher Standard Deduction and forget about itemizing (you probably will, too). In the long run, we’ll all be paying more in taxes. Have you done your taxes yet?

Got my federal refund in 8 days. State refund in 18 days. Since most of my income is social security I end up paying no taxes. Got back about 1500 this year. Most of which for go for my insulin which is quite pricey.

Steve, glad you got some refunds. I try to “break-even” with my Federal and State taxes. But now with my NY State pension and Social Security “Spousal Benefits” my withholding needs to be tweaked.

Just dropped off all the paperwork last week, then had to follow up with stuff I’d forgotten (insurance declaration page) or hadn’t received yet (1095-C). We usually get a little bit back, but I hate a big refund—it means the government has been using my money interest-free all year!

Deb, I’m with you! I like to “break-even” on taxes. I don’t like to pay a lot or get a big refund. Hope you get some money back, though!

Phil loves the big refund so we always get money back. I can’t make any headway with Deb’s argument with him.

Patti, we have a lot of friends who deliberately up their withholding so they get a big refund check from the U.S. Treasury each year. They don’t understand why they’re losing out no matter how many times I explain it to them.

But what about the big Republican tax cut? I demand George get his refund!

We’ll do ours the week after we get home.

Jeff, I should be fine next TAX year. I had to guess how much withholding to go with when my pension started. The same with “Spousal Benefits.” I’ll just increase my withholding for 2018 a little and we should be fine.

We did increase our withholding last year, so we generally break even or get a little back.

Jeff, breaking even or a small refund is the Ideal.

Jackie says you made too much in the stock market.

We’re taking the standard deduction.

Jeff, I did make a lot of money in the Stock Market in 2017. But it could all go away in 2018!

I fill out the paper form by hand, making sure at strategic points to make my 5s look like 6s, my 4s like 9s, and my 7s like just about anything. And vice-versa of course. makes me MILLIONS!

Dan, I’m loving TURBOTAX’s e-File feature. No more printing out forms and standing in line at the Post Office to mail my taxes. Just click the mouse and you’re done!

I can’t comment too much on the situation in the USA – besides wishing you the best and a nice refund. 🙂

But in Germany you can use a state supplied online system which is good enough for me since I retired – while working as a freelance IT consultant I needed help from an accountant of course.

And in Hungary we have a bad joke:

Only the poor and the stupid pay taxes!

Wolf, most American overpay on their taxes because they don’t keep good records or take the time to learn the system. There were plenty of incentives, but now with the new TAX REFORM plan, many taxpayers will just take the new higher Standard Deduction next year.

I dropped mine off a week ago. I use a CPA, and it’s well worth the $ considering how bad I am at math.

I have never wanted to pay quarterly taxes (did so once and hated it) so I always have extra taken out. Since getting soc sec, I’m going to wait until I have received it for a full year, and stabilized my IRA payments to adjust my withholding amnt.

I have always enjoyed getting a nice refund check, but will stop that after next years taxes are finished

Maggie, I’m still fiddling with my withholding and I’m sure I’ll have to fiddle with it again when I start collecting my Social Security when I turn 70.

Dropped them off a week or two ago, will go to get them and discuss adjustments next week. We have a lot of medical expenses, so we’ll probably continue to itemize. As long as we get our home payment interest as a deduction, we’ll be okay, I guess. We only have my pension and Barbara’s tiny Social Security check.

Rick, the mortgage deduction gets capped this tax year. I know California, NY, and some other states are challenging it.

This poor old pensioner uses the EZ form! I think I’ll get a modest refund and spend it on the dang-blasted rise in our property taxes!